Recent News & Articles

| News / Article Summary | Go To Article |

|---|---|

Vale Russell CousinsRussell Cousins passed away on Wednesday the 20th of May 2020. Condolences to his wife Colleen and to their family. He fought for justice right to the end. Russ was a one of a kind giant who felt the injustice of corporate greed. He went into battle not just to bring justice to his family but to as many other victims of financial system crimes and misconduct as possible. We will miss Russ Cousins but he leaves a legacy that bank warriors will carry forward. |

Read More... |

The Sins of WestpacAn essential in-depth analysis of Westpac bank's dark past. Dr Evan Jones shines a light on legacy cases that multiple Westpac CEOs have refused to properly deal with. It's all here - the Westpac Letters - the Foreign Currency Loan Scandal - Westpac and the Royal Commission. |

Read More... |

Clydesdale Duo Set For Sydney Showdown With NABOur UK brother bank warriors Ian Lightbody and John Guidi are flying into Sydney for NAB's AGM on 18.12.19. Banks should have realised by now that activists are united around the country and around the world. The old delay, deny, deceive routine just doesn't work anymore. Victims of predatory banking know exactly what was done to them, how it was done, who profited from the misconduct and who is covering it up. Brave whistleblowers and gutsy journalists are assisting the path to justice and remediation. |

Read More... |

Villains Of Banking Must Be Brought DownWhen BRN first formed one of our first claims was that banking was "organised crime on a grand scale." This article is so perfect it is a must read. Banks really are run and organised by lawbreaking supervillains. We need powerful superheroes to bring them to justice. Apart from all the activists, whistleblowers and journalists that are doing a great job exposing crimes - the regulators have now been embarrassed into action after decades of the light touch "see no evil" approach. |

Read More... |

The Buck Always Stops With The CEO and BoardWestpac needs to show the community it has taken clear accountability. Brian Hartzer's tenure will come under pressure, but the board also has questions to answer. |

Read More... |

Warriors Fire Up Bendigo Bank AGMBank warriors did all of us proud at the Bendigo Bank AGM. Critical issues are being put on the table in public by activists that are not tolerating the way banks have done business in the past. This is how we get reform. Board members must realise that cover-ups and deception are no longer an effective way to run a business. Great work from Craig Caulfield and the team that attended - see this great summary and some video highlights right here. |

Read More... |

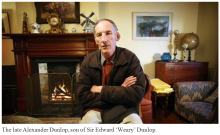

Perpetual Indifference Crucified Son Of Aussie War HeroA very sad story. The ill son of war hero "Weary" Dunlop ripped off by finance sector parasites ... and no-one in a position to help the family will take responsibility. Thanks to bank warrior Boyd Fraser the relatives of now deceased Alexander Dunlop have a chance to see justice. Boyd has his own battle with Perpetual and he's not going down without a fight and while he's at it he wants to help other victims too. This is an amazing case showing just how dodgy some characters are in the "business" world. |

Read More... |

Banks Using Smoke and Mirrors AgainIt's pretty hard to trust Anna Bligh and the Australian Banking Association when you consider the history of banking in Australia since the first Code of Conduct came into existence in 1993. The Soviet Union had possibly the finest documentation protecting the Human Rights of its citizens. Words on paper don't cut it..!! The system must be structured to serve the people's legitimate needs and interests. The Banking Codes have always served the interests of the banks. The new code is no different. But don't worry folks ...... there is light at the end of this long and torturous tunnel. |

Read More... |

Westpac Scandal About To BlowDr Evan Jones has recently commented on several cases Bank Reform Now has been assisting with. The Hayes and Uebergang cases raise very serious issues for Westpac. CEO Brian Hartzer wasn't at the bank when these issues surfaced but he can read. When Westpac was on the edge of collapse drastic measures were part of the rescue response. It's all been detailed in Hansard and then Senator Paul McLean's book Bankers And Bastards. The Westpac Letters scandal showed how the bank's board and their lawyers operated. We know they broke the law. We know they destroyed lives and businesses. Colin Uebergang suffered as a direct result. It's not good enough to pretend the bankers were saints in the 90s. We all now know the truth. |

Read More... |

Appalling Banking Will Be Fully ExposedAFCA Chair Helen Coonan says community trust in the finance sector had been "shattered", with financial institutions causing "despair and hopelessness in many broken lives and broken businesses." If a key part of the economy profits from this type of crooked dealing with customers something is terribly wrong. If we have to remove one CEO after another so be it. Our sense of justice has not been tempered .... it's been honed razor sharp and it will be used to remove recalcitrant bankers, regulators and politicians. Justice has been delayed ..... it will not be denied and it will be sweet. |

Read More... |

Hayne Hamstrung From The StartNationals MP Barry O’Sullivan triggered the Royal Commission being called by Turnbull and Morrison but no politician was responsible. Bank reform was on the agenda thanks to brave whistleblowers and gutsy journalists like Jeff Morris and Adele Ferguson. Victims of bank misconduct and activists worked on the push to reform using everything they had. Social media, mainstream media and political contacts were worked tirelessly. The bankers saw what was coming and decided to put their inquiry up with their terms and their commissioner by using their Prime Minister and their Treasurer. Even though the Royal Commission was hobbled from the start it did serve a purpose... and everyone very well knows it covered up more than it exposed. This is an excerpt from Michael Roddan's book The People vs The Banks. The battle is still being waged and the people will win the war. |

Read More... |

Senate Inquiry Misses The PointThe Hayne RC and the Senate Access To Justice inquiry have dropped the ball. The only way banks can engage with clients in the heavy handed, deceptive, unconscionable and often criminal way that they do is thanks to a "justice" system that enables and allows them to get away with serious abuses. Any other business or individual that treated clients in the way the banks regularly do would see perpetrators fined and jailed. Yes - the abuses we have researched are that serious. Politicians and multiple inquires have been informed. So clearly the other protection required by banks is political. Therefore until people take political action to reform the system nothing will be achieved. Election 2019 is the time to take action. |

Read More... |

Whistleblower Drops Bombshell On SenateJeff Morris is blowing the whistle even harder now. The Senate has been informed and anyone who reads Jeff's submission to the Access To Justice Inquiry will learn the truth about the way banks operate. Bank can no longer deny the bleeding obvious. BRN has cases in front of all the major banks ... and they involve matters exposed by Jeff right here. |

Read More... |

NAB Promises To Play FairAll four major banks have now committed to becoming Model Litigants. NAB was the last to do so. Acting CEO Phil Chronican who will soon take over as Chairman of the bank's board was in the hot seat at the March 2019 House Economics Committee bank CEO grilling. He made it clear that the bank is committed to acting ethically, morally and fairly when dealing with clients where a dispute exists. This is a critical breakthrough in the quest for justice. Mr Chronican and other bankers have been given cases where the bank's lawyers most certainly did not act as Model Litigants. |

Read More... |

ASIC Wants To Play FairASIC boss James Shipton is talking tough with calls to rebuild trust in the finance sector and for bankers to be fair in their dealings with clients. It shouldn't be so hard. All that is required is for ethical behaviour to become the norm. Bankers need to realise they don't deserve a disproportionate share of their client's and the nation's wealth. The fleecing must stop. |

Read More... |

Bankers Are Robbing The CountryDon't let this article slip by - you don't see this exposed in the mainstream media every day. The banks have been allowed by corrupt politicians to steal our wealth and freedoms. Adam Creighton revealed the way it's done before Hayne delivered his limited report. Spread this message far and wide. The system is corrupt and in need of structural reform. Join in with Bank Reform Now to get the job done. Stand - Unite - Make It Right. |

Read More... |

BOQ ExposedIt's not just the big four banks that have been abusing their clients and the law. Second tier operations like Bank Of Queensland got off even lighter than the big banks. Bankers need to look at what even the impaired Royal Commission managed to do to AMP. Michael Sanderson is owed around $2 million after BOQ manipulated valuations to assist its asset stripping sting. Time for the bank to pay up. See story for important information re: valuation abuse; Equality of Arms; Model Litigant guidelines. It's a game changer. |

Read More... |

Thorburn Displays More Than Poor JudgementIt is not just lack of judgement and poor governance in his own office. Rosemary Rogers also worked in Cameron Clyne's office. The real issue is this - if the CEO could not see crimes and misconduct in their own office it is not surprising that they may not have seen criminal cells working in the bank right around the country. We gave Mr Thorburn evidence of these crimes in October last year. He tried to cover it up with a dodgy mediation process ..... he will be looking for work very soon. |

Read More... |

Sham Bank Royal Commission About To Be ExposedA beaut article summarising the possible findings of the Hayne banking Royal Commission. Well done Karen Maley from the AFR. Well worth a read but check out the BRN kicker at the end. All is not as it seems. For years both major parties allowed crime and corruption to fester in finance. It is time for bold new ideas. |

Read More... |

Rowena Orr QC Has Been InformedCBA survivor, warrior and BRN friend Rory O'Brien makes the case ....... for some inexplicable reason the Royal Commission is covering up the CBA / Bankwest heist. BRN says that respect is earned. Judges and politicians do not deserves any respect (or votes) if they protect criminals in the finance sector. The RC and now QC Rowena Orr have been told .... they remain on the hook .... and will remain so until a proper investigation is completed. Read this powerful letter sent to Rowena Orr QC. |

Read More... |

World Sees Australian Banks ExposedAussie bank misconduct revealed by the light-touch Hayne inquiry is still so shocking that politicians, bankers and regulators will never be able to go back to the good old days of rampant fleecing and misbehavior. Great report from Reuters' Byron Kaye. |

Read More... |

NAB Using Ex-Victorian Premier To Compensate VictimsThe bank warriors have made their powerful presence felt at another bank AGM - this time at NAB's. Fireworks were seen with shareholders more than angry. Billions have been destroyed by poorly performing bankers who still demand big money for shocking conduct. Craig Caulfield initiated and co-ordinated the warrior's AGM action. He and the other warriors are champs in the battle for justice. Here reporter Joyce Moullakis explains what NAB is trying to do with the help of Jeff Kennett. |

Read More... |

NAB's Ken Henry In The DockWell, well, well - another great bank warrior ... Rowena Orr QC - has had her hands full today at the Royal Commission. She has been dissecting an insider. Ken Henry made it very clear that he doesn't appreciate being questioned. Rowena Orr was not copping the attitude. Here are some key points from James Thomson. |

Read More... |

CBA Pressures Customer With A ComplaintCanberra man Neil Hermes reports being intimidated by CBA staff less than three hours after he told them he had submitted evidence of his dealings with the bank to the Royal Commission. The staffer that did that is living in the old days. Banks must change. The ones that don't will be left behind. Neil was a CBA Bankwest victim. The Royal Commission has let him down so far. It must be extended and really sort out the Bankwest scandal. |

Read More... |

People Power - Bank AGMs - Round 1HOT OFF THE PRESS - Craig Caulfield has been battling to get justice from the Commonwealth Bank of Australia (CBA) for nine years. He has just sent us his latest on the first bank - CBA - to feel the power of the people during the AGM phase of the campaign. There are other banking events over the next few weeks. Join in. Here is what Craig had to say - |

Read More... |

NAB Banker GuiltyThis NAB story is very interesting. Spot the difference - A banker rips off the bank and is quick smart reported to police - pleads guilty in court - and most likely will be jailed. A banker rips off a client ..... well you know how it used to end. But not anymore. We are now in a changed environment. Reforms are brewing that will see bankers heavily fined and jailed ..... and their victims fully compensated. Bankers that do not accept the new reality will be at very high risk of losing their jobs and bonuses .... at best. At worst ..... do not pass go ..... you know exactly where you will be heading. Any banker knowingly covering up serious crimes and misconduct will be held accountable. |

Read More... |

CBA Victims Corner CEOSelwyn Krepp and Bob Bourne know how ruthless bankers and their lawyers can be. Both victims of CBA - they took the opportunity to meet with CEO Matt Comyn in Canberra .... right after the Economics Committee finished grilling him. BRN suspects Mr Comyn now has a much better understanding of the situation bank victims face. There is not much worse than losing you home, business and job thanks to bank misbehaviour. |

Read More... |

ANZ in the dock - Big4 Banks ReviewHansard Transcript - The Treasurer has asked the Standing Committee on Economics to inquire into and report on a Review of Australia's Four Major Banks. This is ANZ's appearance at the fourth review. Members of the BRN team were in attendance to bear witness. The MPs on the committee did a magnificent job. The CEOs were not able to bluff their way out of being accountable. We have saved the transcript here for you. |

Read More... |

Westpac in the dock - Big4 Banks ReviewHansard Transcript - The Treasurer has asked the Standing Committee on Economics to inquire into and report on a Review of Australia's Four Major Banks. This is Westpac's appearance at the fourth review. Members of the BRN team were in attendance to bear witness. The MPs on the committee did a magnificent job. The CEOs were not able to bluff their way out of being accountable. We have saved the transcript here for you. |

Read More... |

CBA In The Dock - Big4 Banks ReviewHansard Transcript - The Treasurer has asked the Standing Committee on Economics to inquire into and report on a Review of Australia's Four Major Banks. This is the Commonwealth Bank of Australia (CBA) appearance at the fourth review. Members of the Bank Reform Now team were in attendance to bear witness. |

Read More... |

Frydenberg Sees The LightPublic pressure works. Scott Morrison and Josh Frydenberg have been contacted many times about bank crimes. They both have been given case histories. They know have no chance of winning back public trust unless they extend the Royal Commission. Bankers and regulators must be held accountable and victims must be compensated. It's a no-brainer. Josh Frydenberg must contact Bill Shorten and arrange bipartisan support for an extension .... now. |

Read More... |

Corruption Is Baked Into BankingBankers have a well-oiled operation which has enriched and protected them. Henchmen in law, politics and the regulatory system have all played an essential role in enabling corruption in the banking and finance sector. |

Read More... |

Bankers Prosper While We SufferJohn Quiggin nails it - the financial system is fundamentally flawed. It is used as a tool to siphon the wealth of the people and the nation into the hands of the elite. We don't have to wait until the next crash to fix this diabolical mess ........ but we will if people do not find out how they are being screwed and then take appropriate action. First step here in Australia is to extend the powers and duration of the Banking Royal Commission. Sign the petition below. Register for updates on our website and join our Facebook page. Then get ready to help push our politicians to do the right thing. We have an election coming up .... and the pollies know they are facing a wipe out. |

Read More... |

Bank Victims Stories Reaching ParliamentPublic pressure on politicians does work. Michelle Matheson was a bank victim ... she is now a bank reform activist kicking goals. Michelle has lobbied politicians, supported other bank victims .... and activists. She has now seen her story told in Parliament House. Speaking out is the only way to educate and motivate others to take effective action. For those willing to stand up and stand firm ... we salute you. To those who support bank victims and the fight for Bank Reform ... we thank you. |

Read More... |

NAB & CBA Committed CrimesBanking Royal Commission exposes NAB and CBA as committing criminal acts. There is a pattern here. The banks will soon respond and deny they have engaged in criminal actions. What will Commissioner Hayne do about it? Maybe he could ask for more power and time because what has been exposed so far is no surprise at all This is bread and butter banking. There is a depth of criminality that has not been touched. An extended Royal Commission will see his colleagues in law investigated as well as liquidators and other accomplices in deep banking. It won't be pretty. |

Read More... |

Turbocharge Banking Royal CommissionIn a move sure to get results Senator Fraser Anning is hosting a media event to show all Australians that the banking Royal Commission needs to be enhanced and extended to do the job required. On Tuesday August 14 2018 bank victims and other concerned citizens are coming to Canberra to support his efforts. On the same day he is likely to make his maiden speech. Bank Reform Now hopes the finance sector and the way it is abusing all of us will be featured. |

Read More... |

Matt Comyn - Make The CallThe CBA Box Hill Scandal has made news around the world. Debbie Barker has sent an update to BRN. We think that Matt Comyn has no choice but to call the victims and pay them full compensation. And while he's at it .... how about a genuine apology. Oh ... and Mr Comyn should also call our friend Tony Rigg. Don't you think 30 years is a bit long for Tony to wait? What are you waiting for Matt? |

Read More... |

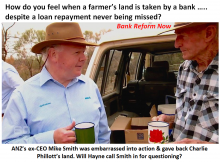

Our Farmers Will Be HeardThis coming round of the Royal Commission will reveal many sad stories and the horrific number of cases showing the ruthless and bad behaviour by bankers in the bush. Senator Williams sums it up very well “The stress on families, the marriage breakdowns, the suicides; there’s been a lot of harsh goings-on by the banks for too long and when it involves land, farms and breeding herds that have often been in the family for generations, you never get over (being forced off your land),” |

Read More... |

Will the Swiss vote for financial justice?It is slowly dawning on people that a secretive and powerful private banking cartel controlling the world's finance system just might not be in the best interests of the bulk of people living in every country on the planet. The Swiss Vollgeld initiative aims to make the financial system safer by stripping banks of the power to create money. It will in effect turn their liquid deposits into "state" or "sovereign" money. This is a critical step in the reform process. Did you know that Aussies will be given the chance to vote for a very similar proposal in 2019? It just makes no sense to have bankers exploiting powers that rightly belong to the people via their sovereign governments. This article is essential reading. #OzElection19 will give Aussies the chance to top what the Swiss are attempting. See below for how you can help. |

Read More... |

Unconscionable Banking Laid BareHave you ever wondered why a bank would default you when you've never missed a payment? Or why the bank would sell your confiscated property for much less than market value? Doesn't make sense to sell it cheap and leave you with a debt that could have been significantly reduced if not paid off in full. Well Natasha Keys spills the beans. From a banker's point of view it all makes perfect sense. It's a very dirty business .... as you will see. |

Read More... |

Pages

Latest News & Articles

Bank Victims Horror Stories

From Extend RC Parliament Event

>> See ALL Horror Stories List

Print PDF

Print PDF