"The banking system is corrupt. The time has come to clean it up.

Take action to help bring about essential bank reforms.

It must be done. It can be done. It will be done - with your help."

Donate & Benefit

![]() Your donation will help Bank Reform Now's campaign move forward with the mission to see justice for bank victims, stop the corruption and expose the lies, Donations will also enable on-giving to victims of bad banking practices and Mental Health Services.

Your donation will help Bank Reform Now's campaign move forward with the mission to see justice for bank victims, stop the corruption and expose the lies, Donations will also enable on-giving to victims of bad banking practices and Mental Health Services.

Find Out About BRN

![]() BRN was founded by Dr Peter Brandson, a family GP in regional NSW South Coast. A victim of Predatory Lending by the National Australia Bank (NAB), he is standing up and calling for action so other families and businesses are not harmed.

BRN was founded by Dr Peter Brandson, a family GP in regional NSW South Coast. A victim of Predatory Lending by the National Australia Bank (NAB), he is standing up and calling for action so other families and businesses are not harmed.

Bad Banking Stories

![]() Read stories from just a few of the many victims of Bad Banking Behaviour. Have you lost your home, assets or business or suffered personal or family loss? Share your experience with us.

Read stories from just a few of the many victims of Bad Banking Behaviour. Have you lost your home, assets or business or suffered personal or family loss? Share your experience with us.

Take Action Now!

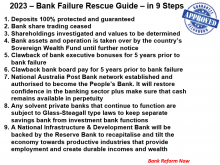

![]() The Global Financial Crisis (GFC) was caused by inappropriate bank lending. This issue affects every person on the planet. It will happen again if we don't act now. It is up to us to advocate and work for change.

The Global Financial Crisis (GFC) was caused by inappropriate bank lending. This issue affects every person on the planet. It will happen again if we don't act now. It is up to us to advocate and work for change.

Latest News & Articles

Bank Victims Horror Stories

From Extend RC Parliament Event

>> See ALL Horror Stories List

- The Rothschild Brothers