Draft Terms Of Reference Royal Commission Banking & Finance

Australian Banking and Finance Sector - In Dire Need Of Reform

Terms of Reference – Banking and Finance System Royal Commission

A Draft for discussion - Dr Peter Brandson (CEO Bank Reform Now)

Preamble: The banking system is flawed and faulty. It does not serve the needs or interests of customers, citizens or even the country. This is readily seen when one reviews the billions of dollars’ worth of fines major banks around the world have had to pay since the 2008 Global Financial Crisis (GFC). These fines are a fraction of the profits made and usually involve deals that see bankers keep their liberty and their bonuses.

In fact - taxpayers, shareholders and customers end up paying the price for corporate crimes that involve: predatory lending; fraud, forgery; asset stripping of farmers, retirees, small businesses & “unsophisticated” investors; rate rigging; commodity market manipulation; money laundering; drugs & arms trafficking; terrorism funding; financial planner scandals; managed investment scheme scandals; insurance scandals; and tax evasion. All this can only be possible with a political and judicial system that is deliberately charged with protecting and rewarding wrongdoers. This is a systemic problem with politicians, regulators, judges, valuers, ratings agencies and major legal & accounting firms all playing a role facilitating these crimes. This explains why it has been so difficult to bring about a full investigation of the system. There are powerful vested interests that want to maintain the status quo and they appear to have significant power over the political class.

The Australian Big Four banks did not survive the 2008 GFC in the way that has been portrayed by bankers, politicians and the mainstream media. Billions of dollars had to be pumped into NAB and Westpac by the US Federal Reserve. Quantitative easing, bank borrowing guarantees and record low interest rates are a last ditch effort to keep a disintegrating financial system afloat. Asset prices globally are being crudely propped up to give the illusion that all is well.

Our banks are linked to a worldwide Federal Reserve System and their shareholders are in large part foreign banking interests. The Bank of International Settlements (BIS) sits at the top of the pyramid. The system is debt based and has placed all nations into unsustainable never to be repaid debt but our hard earned tax dollars are transferred to pay interest while more and more of our people live lives of quiet desperation. Any ensuing crisis will be exploited to put in place further limitations on Australian sovereignty and deeper austerity measures which will be used to excuse and facilitate the sale of Australian assets to foreign interests.

Our government has the constitutional authority to be involved in the supply of money. Various historical events have managed to transfer this important responsibility to a powerful cartel of private banking interests. It is possible to create a system that allows the “profits” of credit creation to remain with the people. The only way this can work is by having an accountable, transparent and honest monetary system operating in the interests of the citizens and their nation. In addition we must have effective democratic institutions with honest and accountable elected representatives watching over this on our behalf.

This Royal Commission seeks to use its extraordinary powers to fully expose how the system operates. We will hear from the industry players – past and present – as well as bank customers. We will seek to facilitate recompense to bank victims. We will seek to punish bankers and their associates that are found to be criminally abusing their positions. We will investigate proposals that will make the system sustainable, honest and fair.

Note from Bank Reform Now team and CEO - Dr Peter Brandson: We believe the terms below to be a gold standard that covers the key issues requiring investigation while leaving scope for further expansion as the inquiry progresses. Significant research and discussion has helped formulate this proposal. Many industry and political insiders will much prefer a watered down inquiry if they can’t actually stop it altogether. People wanting a proper inquiry will need to make it very clear to all supportive parties and politicians that they want to go for gold. At this point it is clear that One Nation, Katter’s Australian Party, Nick Xenophon Team, the ALP and The Greens support a Royal Commission. Let’s see which parties and politicians also want to go for gold.

Draft Terms of Reference:

Implement a commission of inquiry with extraordinary powers to investigate all facets of the banking and finance system. Including, but not limited to, business practices, conduct and culture with regard to:

1) The provision of mortgage lending, including investigation of:

v. the falsely held common belief that banks lend to borrowers only money that has been deposited by savers

2) Banks and the vertical integration of their associated services, including:

ii. conflicts of interest and whether these systems encourage illegal, unethical, predatory and unconscionable business practices

3) Individual bank victims and their experiences of bank activities such as:

iii. Corrupted dispute resolution procedures including the Financial Ombudsman Service and Farm Debt Mediation structures

4) Groups of bank victims involved in particular scandals such as:

5) The salary and remuneration structures for bank staff, CEOs and Directors including:

viii. whether these remuneration systems create an irreconcilable conflict of interest between bankers and their clients

6) The relationship between banks, governments, politicians and political parties, including:

iv. whether these practices have a corrupting influence on decision making

7) The relationships between banks and associated industries and structures involved in the business model of banking and the regulation of banking, including:

viii. inquiry into the costs that are borne by bank customers due to these relationships and the practices that they encourage

8) Investigate potential conflicts of interest and inequities regarding the function of the courts in bank related litigation such as:

iv. the lack of Equality of Arms. When a bank takes on a customer the customer must have equal access to legal expertise. Without this a fair hearing is impossible and justice unobtainable.

9) Investigation of the interactions between banking & related interests, government policy (including taxation) and the price of housing.

10) Investigation of the opportunity cost to the nation of the current debt based monetary system as opposed to a Sovereign Monetary system. The current system sees far too much of the nation’s wealth transferred to banking and associated interests. In other words financial system players are receiving a disproportionate share of the wealth of the nation and its people. Related issues to investigate will include:

ii Whether systems can be developed to enable “profits” from the provision of a well-functioning monetary system to remain with the Sovereign people.

11) The nature of Investment Banking versus Trading Bank services, including an investigation of:

xi. Glass Steagall type laws to insulate regular users of saving banks from the above machinations.

12) The proper protections and financial compensation of financial system personnel that expose illegal and unethical practices i.e. Whistleblower protections

13) The investigation of banks and their facilitation of criminal activity including, but not limited to:

14) Appropriate penalties and enforcement of penalties on banking and financial system personnel involved in criminal / unethical / predatory conduct. Penalties to consider include:

iii. compensation of bank victims with non-tax-deductible payments made by the guilty personnel and the financial institution where required

15) Any matters relevant to further understanding of the above material and concepts.

Powers of the Inquiry:

This is a comprehensive investigation with wide-ranging powers. All relevant documents regarding any aspect of investigation will be made available by banking and regulatory institutions. Destruction or “loss” of documents will not be tolerated, will be subject to investigation and may lead to penalties where appropriate.

Persons of interest shall be required to appear and answer all questions. Deception and obfuscation will not be tolerated.

All evidence collected will be made available to facilitate compensation to victims and prosecution of criminal actions.

___________________________________________________________________

Notes / Explanations / References / Examples regarding issues of import:

A) Investigate the 2008 CBA takeover of Bankwest and allegations of unconscionable foreclosures of Bankwest borrowers, including:

a) all events and evidence relating to the price adjustment and Dispute Notice process which occurred after the takeover; including but not limited to notices issued pursuant to clause 10 (Dispute Notice) of the 2008 Bankwest Share Sale Deed;

b) all events and evidence relating to the Warranty Claim Notice process which occurred after the takeover; including but not limited to notices issued pursuant to clause 16 (Warranty Claim Notices) of the 2008 Bankwest Share Sale Deed;

c) The use of non-monetary default provisions within credit contracts which CBA/Bankwest relied upon to deem customers as impaired pursuant to the provisions of the 2008 Bankwest Share Sale Deed.

d) Investigate the allegations that CBA/Bankwest used unconscionable, misleading or deceptive conduct to cause customer loans to be categorised as impaired as at the 19th Dec 2008. The process of causing these loans to be categorised as impaired as at 19th Dec 2008, can have occurred;

(1) prior to 19th Dec 2008; or

(2) on, or after 19th Dec 2008 using the aforementioned retrospective impairment claim processes in (a) and (b);

e) all events and evidence relating to the capital adequacy of CBA and Bankwest and CBA's wholesale funding obligations of the Bankwest loan book;

f) ascertaining whether the executives of CBA, Bankwest or any of its receivers gave testimony in Parliament that was misleading;

g) ascertaining whether the conduct of Executives and Board members within CBA & Bankwest contravene any points of civil or criminal liability pursuant to the relevant legislation;

h) the role of insolvency practitioners and valuers in the unconscionable foreclosures;

i) the role of the regulators relating to the takeover; and

j) any other relevant information.

B) Investigation of ANZ takeover of Landmark Dec 2009 and subsequent foreclosure of Landmark borrowers will require:

- subpoena all documentation relevant to ANZ purchase and subsequent re-configuring of Landmark borrower facilities.

C) Examination of entire loan process for SMEs / farmers with a view to investigating the potential for entrapment of borrowers will require assessment of:

a) the nature of the contract (especially in the light of recent changes to ‘unfair contracts’ legislation);

b) the nature of facilities (esp short-term, including the now favoured bill facility, for long term purposes, but which facilitate default);

c) the nature of security demanded, including guarantees by principals and other parties;

d) the extent of verbal promises by lending officers, later reneged on or denied;

e) the imposition, often discretionary, of usurious penalty interest rates;

f) the pursuit of the foreclosed borrower to bankruptcy (proscribing the latter’s legal redress).

D) Previous government inquiries and cases highlighting particularly heinous crimes:

i. 2012 - The post-GFC banking Sector Inquiry – Featured CBA / Bankwest Scandal

à Submissions - e.g. Mr Trevor Eriksson (PDF 260KB) (CBA / Bankwest), Mr Sean Butler (PDF 296KB) (CBA / Bankwest)

ii. 2013 – The performance of the Australian Securities and Investments Commission

à Submissions - e.g. Ms Jean Andersen (PDF 99 KB) (CBA); Dr Barry Landa (PDF 266 KB) (NAB); Mr Tony Rigg (PDF 127 KB) (CBA), Claire & Chris Priestley (PDF 317 KB) (NAB)

iii. 2016 - Impairment of Customer Loans

à Submissions – e.g. Dr Barry Landa (PDF 28 KB) (NAB), Mr Anthony Thomas Rigg (PDF 98 KB) / (PDF 2183 KB) (CBA), Mr Michael Sanderson (PDF 424 KB) (BOQ), Mr & Mrs Philipp and Lynne Kreutzer (PDF 277 KB) (NAB), Ms Suzi Burge (PDF 44 KB) (CBA), Ms Jean Andersen (PDF 237 KB) (CBA), Ms Faye Andrews (PDF 174 KB) (NAB), Mr Sean Butler (PDF 342 KB) (CBA / Bankwest), Ms Rita Troiani and Ms Janine Barrett (PDF 125 KB) (NAB), Mr & Mrs Rodney & Ioanna Culleton (PDF 218 KB) (ANZ), Mr Adrian Beamond and Ms Deborah Smith (PDF 278 KB) (ANZ), Mr Trevor Eriksson (PDF 291 KB) (CBA / Bankwest), Mr Chris Evanian (PDF 7394 KB) (CBA / Bankwest)

iv. Other Noteworthy Cases - likely to be confidential in any inquiries to date:

Rory O’Brien (CBA / Bankwest) - Developer Rory O’Brien sues Bankwest / CBA lied to NSW sheriff over BankWest loan / Developer Rory O’Brien settles Bankwest dispute

Jim and Debbie Barker (CBA) - CBA court battle: Couple whose home was repossessed says bank forged signature

Giulia Mandarino (CBA) - CBA was aware of fraud allegations

Thomas Brookes (ANZ) - ANZ Bank exposed falsifying documents & stealing family's home

Patricia Thirup (NAB) - Mortgage fraud scandal

Erica Biritz (NAB) - A NAB act of treachery comes back to bite the bank

Malcolm Taylor (NAB) - NAB not off the hook in butchered docs deal

v. Evan Jones Reports on what governments and their inquiries appear to miss:

To fix Australia’s banking culture: Start sending bank CEOs to gaol

The Dark Side of the Commonwealth Bank

Illusion and Reality at the National Australia Bank

E) Explanations of credit creation

Modern Money Mechanics – the Federal Reserve Bank of Chicago

Money Creation In The Modern Economy – The Bank of England

F) The GDP conundrum. When a bank writes up dodgy loans or sells a useless insurance policy the nation’s GDP increases. Similarly GDP is boosted when bushfires destroy properties that are subsequently rebuilt or when governments purchase weapons used to destroy properties in other nations. The point being that GDP is not a good way of measuring prosperity, wellbeing and happiness of ordinary people. Any growth, movement of capital or business activity - whether useful of not - enriches upper echelon financial interests. Bank Reform Now has discussed this key point before. A properly functioning banking and finance system must serve the interests of the people. Reforming the system after an effective inquiry will improve many facets of our nation including the time people have to spend enjoying their lives free of much of the financial stresses and strains that have been imposed on them.

G) Well off nation or well off banks? Genuine reforms will lead to a more honestly run banking system. The banks will not be able to benefit from criminal and unethical business practices. They will become less profitable - therefore lower dividends, less capital gains and less CEO pay will become the norm. This is not a problem. Banking and the monetary system is a utility that helps people trade goods and services. The people involved in this system do not have any right to a disproportionate share of the nation’s wealth. The pay for people in this and associated industries will normalise to a far more realistic level along with their profits and influence on society. Investors will be free to direct their capital and interest to profitable and hopefully useful business ventures. This change is long overdue and will lead to a much better way of life for the vast majority of people.

H) Elements of a Contract

1. Offer - One of the parties made a promise to do or refrain from doing some specified action in the future.

2. Consideration - Something of value was promised in exchange for the specified action or non-action. This can take the form of a significant expenditure of money or effort, a promise to perform some service, an agreement not to do something, or reliance on the promise. Consideration is the value that induces the parties to enter into the contract.

The existence of consideration distinguishes a contract from a gift. A gift is a voluntary and gratuitous transfer of property from one person to another, without something of value promised in return. Failure to follow through on a promise to make a gift is not enforceable as a breach of contract because there is no consideration for the promise.

3. Acceptance - The offer was accepted unambiguously. Acceptance may be expressed through words, deeds or performance as called for in the contract. Generally, the acceptance must mirror the terms of the offer. If not, the acceptance is viewed as a rejection and counteroffer.

If the contract involves a sale of goods (i.e. items that are movable) between merchants, then the acceptance does not have to mirror the terms of the offer for a valid contract to exist, unless:

(a) the terms of the acceptance significantly alter the original contract; or

(b) the offeror objects within a reasonable time.

4. Mutuality - The contracting parties had “a meeting of the minds” regarding the agreement. This means the parties understood and agreed to the basic substance and terms of the contract.

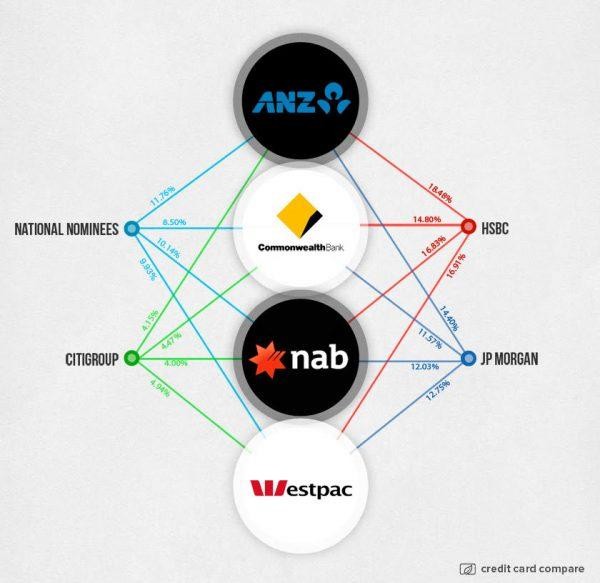

I) Ownership Structure of the Big Four Australian Banks.

HSBC, the biggest shareholder in each of the Big Four, is one of the major international banks with a very well-known and publicly documented record of criminal activity. See:

Banking Giant HSBC Sheltered Murky Cash Linked to Dictators and Arms Dealers

J) By 2015 more than 23% gross corporate incomes (17% of total business incomes) were going to the finance sector. This is totally unjustifiable, unreasonable and not conducive to a just society.

Source: Australian Bureau of Statistics, 5206.0, Australian National Accounts, Table 7: Income from Gross Domestic Product (GDP), Current Prices

The first table is a summary done several years ago. The second table updates the figures for the last few years. Note: Gross mixed income is income of unincorporated businesses.

|

Australia: Gross Business Income at Current Prices (Selected) $ million |

|||||||

|

Date |

Gross Operating Surplus |

|

Gross Mixed Income |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Non-Fin'l Corp'ns |

Financial Corp'ns |

Total Corp'ns |

Fin'l / Total Corp'ns % |

|

GOS Corp'ns & GMI |

Fin'l / Total % |

|

1980-81 |

26260 |

1413 |

27671 |

5.1 |

19268 |

46939 |

3.0 |

|

1991-92 |

78680 |

9614 |

88295 |

10.9 |

39298 |

127593 |

7.5 |

|

2012-13 |

291276 |

73092 |

364369 |

20.1 |

119257 |

483626 |

15.1 |

|

Australia: Gross Business Income at Current Prices (Selected) $ million |

|||||||

|

Date |

Gross Operating Surplus |

|

Gross Mixed |

|

|||

|

|

|

|

|

|

Income |

|

|

|

|

Non-Fin'l |

Financial |

Total |

Fin'l / Total |

|

GOS Corp'ns |

Fin'l / |

|

Corp'ns |

Corp'ns |

Corp'ns |

Corp'ns % |

& GMI |

Total % |

||

|

2009-10 |

261122 |

62465 |

323586 |

19.304 |

108675 |

432261 |

14.451 |

|

2010-11 |

295308 |

65297 |

360606 |

18.108 |

116863 |

477469 |

13.676 |

|

2011-12 |

308675 |

66558 |

375232 |

17.738 |

120364 |

495596 |

13.430 |

|

2012-13 |

291828 |

73211 |

365040 |

20.056 |

122736 |

487776 |

15.009 |

|

2013-14 |

305167 |

79354 |

384523 |

20.637 |

121129 |

505652 |

15.693 |

|

2014-15 |

290601 |

83973 |

374574 |

22.418 |

130657 |

505231 |

16.621 |

|

Dec-15 |

142193 |

43866 |

186058 |

23.577 |

70301 |

256359 |

17.111 |

Bank Victims Horror Stories

From Extend RC Parliament Event

>> See ALL Horror Stories List

Recent News & Articles

Need Support?

Financial Help

Tips & Resources to help you avoid or manage financial difficulty...Emotional Help

Financial stress is a major factor in depression and anxiety, if you are suffering you can get help...Poll

© Bank Reform Now™ - Australian Non Profit Organsiation - campaigning to put a stop to predatory, unconscionable banking practices.

Disclaimer: Comedy, parody and satire will be used across all media platforms during this campaign.

Any similarity to legitimate businesses is coincidental. Corrupt business on the other hand will be treated with all due respect.

Print PDF

Print PDF

Comments

selling off gov owned asetts

the selling off of government owned banks both federal and state should also be looked at to make sure this was done in the correct manner which I am shore it has not been as any sale of a government asset must be put to the people by way of a ref

Banking Royal Commission

This looks good, if a royal commission into banking and finance in Australia goes ahead, how will this document get in front of the right people to be considered when drawing up the official terms of reference for Bank RC? Thanks for keeping it real Bank Reform Now.

Some pollies have seen this

Thanks Ernie - some prominent pollies have already been given the information. It will be up to all of us to make sure that when the terms are being worked on we push for the "gold standard." People power can work - it just has to be used wisely.

Reserve Bank should be investigated

I believe that Reserve Bank should be investigated as they are the one who manipulated the interest rates and economy of Australia! Reserve Bank is not necessarily independent of lobby groups and banks!

More comments can be seen ...

... at our Facebook page - https://www.facebook.com/notes/bank-reform-now/draft-terms-of-reference-...

Turnbull's Tribunal Turntable - keeps repeating

Mention of the original BRN draft terms of reference for a Royal Commission into the Banking & Finance Sector...Turnbull takes a tribunal turnMonday, 22 August 2016 6:56am Ian Rogers Finance regulation

The Australian government may be bending toward an idea promoted by stirrers on its own backbench who have pushed for a form of banking "tribunal" to consider customer grievances.

The Financial Review on Saturday reported that prime minister Malcolm Turnbull on Friday all but gave the green light to the establishment of a victims' tribunal.

"We want to ensure that where there are failings, where there are problems, that we deal with them," he said.

"That's why we gave ASIC $127 million, because they can get on and take the investigations and prosecutions now.

"In terms of improving the way customers and particularly retail customers are dealt with, we're very open to looking at action in that regard and that is the difference between taking real action now, on the other hand proposing a royal commission which would go on for years and years."?

A separate group of agitators, Bank Reform Now, have drafted terms of reference for a royal commission, an angst-ridden document that touches on familiar themes of business practices, conduct and culture and less familiar themes such as the merit of a "a sovereign monetary system".

The BRN version promotes time for any inquiry to consider "individual bank victims and their experiences of bank activities" including "predatory lending", "fraud and unconscionable conduct" and "corrupted dispute resolution procedures".

Labor opposition leader Bill Shorten, meanwhile, continues to make a noise in this debate. Labor, relying on parliamentary library research, pointed out (via the Financial Review) that complaints to the ombudsman has jumped by more than 60 per cent, from 19,000 to 32,000. The biggest increase in complaints were about credit cards.

Terms of Reference

Brilliant!!!!!! Nothing less. I particularly like 7 and `12 below but is it possible to include anyone who is a whistleblower not just those within the financial system personnel. I was a property investor. Investor not speculator and in a unique position to observe and record fraudulent valuations. I was a legitimate whistleblower but am offered NO protection!

7) The relationships between banks and associated industries and structures involved in the business model of banking and the regulation of banking, including: i. the receiver, liquidator, insolvency sector – including an airing and rectification of the current anomaly by which the liquidator is under the authority of the borrower at law but acts exclusively under the authority – and in the interests - of the lender de facto. ii. property valuers iii. the judiciary, lawyers & law firms AND

12) The proper protections and financial compensation of financial system personnel that expose illegal and unethical practices i.e. Whistleblower protections

FOS

Hi in the draft terms above 3] 111 Corrupted Dispute Resolution FOS, we are direct victims of the dispute process where the Determination was not signed or accepted , instead of it going to the panel it just went back to the same omb who would not change his mistakes, he changed our figures around to suit the bank,we already had 5 out 6 loans ruled mal admin of lending the 6th he stiched up for the BANK, 2 top Forensic cpa,s and our own cpa all agreed FOS is wrong 7 yrs and still they wont review our case so we can get correct compensation, FOS does not answer to anyone we have tried media, apra asic, state and fed pollies no one can make them redo our Determination regards G

FOS are corrupt

All orgs you listed are corrupt, useless, will not help you in anyway, as you obviously know. Only thing you can do (& unfortunately they know it & abuse this) is cop it or fight them... We should all band together do a class action & fight the mongrels.

BRN campaign is taking them on

Join in - we are ramping up right now for the 2019 Australian Election >>

Add new comment