BOQ Exposed

Bank Of Queensland Has Debts To Pay - $20K To Call It Quits..?? No Way..!!

Summary:

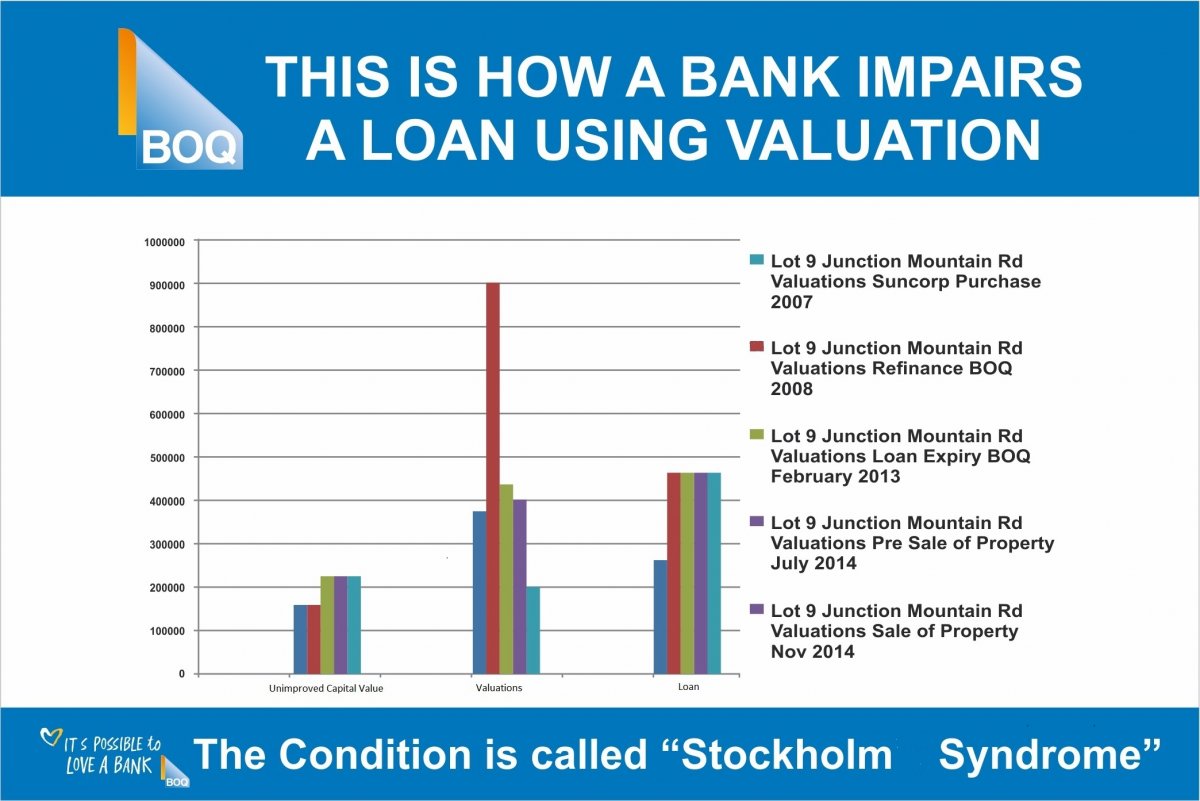

It's not just the big four banks that have been abusing their clients and the law. Second tier operations like Bank Of Queensland got off even lighter than the big banks. Bankers need to look at what even the impaired Royal Commission managed to do to AMP. Michael Sanderson is owed around $2 million after BOQ manipulated valuations to assist its asset stripping sting. Time for the bank to pay up. See story for important information re: valuation abuse; Equality of Arms; Model Litigant guidelines. It's a game changer.

Latest News & Articles

Bank Victims Horror Stories

From Extend RC Parliament Event

>> See ALL Horror Stories List

Bank victims, supporters and concerned citizens want to see...

ANZ CEO Shayne Elliott finally admits documents they used...

In the past bankers liked to present themselves as...

How low can a bank go? Setting up a farmer to strip the...

Print PDF

Print PDF