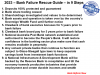

CBA Lies & Cheats To Limit Compo Payments

Jig's up for Narev and his dodgy compo scheme

Summary:

After running the program for 14 months, the bank has only compensated 19 customers less than half a million dollars – despite receiving over 8000 requests for file reviews from clients. Financial planning scandal will lead to bankers leaving the industry. Trust has been destroyed. Lack of trust in banks and governments will lead to economic stagnation. Too much - has been stolen from too many - for too long. This will contribute to the next financial crisis.

Latest News & Articles

Bank Victims Horror Stories

From Extend RC Parliament Event

>> See ALL Horror Stories List

Bank victims, supporters and concerned citizens want to see...

ANZ CEO Shayne Elliott finally admits documents they used...

In the past bankers liked to present themselves as...

How low can a bank go? Setting up a farmer to strip the...

Print PDF

Print PDF